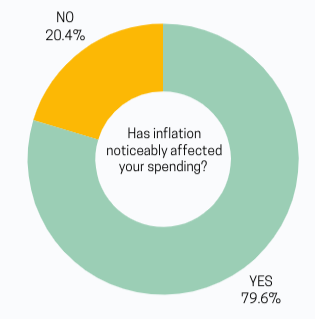

Over the past year, rising inflation has managed to affect the majority of Champe students in their day to day life because of changes made due to struggles of rising prices.

High School students frequently spend their time going out with friends and buying things like food, clothes, and other necessities. Over time, there has been a noticeable increase in prices, so more and more personal money is being spent every day. Saving money has become harder than ever.

“Although I am not much of a spender, I feel that inflation has really affected my spending habits when buying snacks or small treats for myself and other people,” junior Aiden Gayles said. “ I would buy things, for example: boba or food in general or I would occasionally go out to eat with neighborhood friends, however, because of the fact how much inflation has impacted the economy, the prices have gone up and the quantity of food has also decreased. So the amount of times that I would eat out with friends decreased.”

Families as a whole have also suffered the effects of rising inflation. Most had to make a change in their spending plans or decrease grocery trips. The luxury of buying non necessities has also reduced as prices have increased.

“In terms of inflation for my family, I feel although I do not know the specific details of how much it has influenced our spending habits,” Gayles said, “I am aware that there have been wiser decisions made recently. What I mean by this, is that whenever we go grocery shopping we are less likely to buy unnecessary products such as chips and sodas because they can be purchased at a later time. It almost is like a situation of prioritizing what is important to buy before buying our more wanted items.”

Out of all the things inflation has affected, gas prices seem to be the most frustrating amongst students. According to reporter Kelly Anne Smith, the average gas price in the U.S comes out to be 3.29$ per gallon, which is up by 0.19 cents in the last month of February. They will continue to rise on a monthly basis despite the inconvenience.

“I think that a lot of things that I normally would buy at the store are getting pretty cheap,” sophomore Sandy Ryad said. “Like, I work and all, but this whole buying snacks and things is getting expensive. One thing I hate the most was how gas prices got kind of expensive, and how it would drain my allowance trying to buy gas for my car. Thankfully gas has gone down a little. I would cry if I had to pay five dollars a gallon for gas like some people in California do.”

Despite the rising numbers, it is theorized that inflation will eventually decrease over time. According to writer Preston Caldwell, inflation took its fall in 2023 after reaching its peak in 2022, and it is expected to return to normal levels in 2024. From its start in 2021 to its current position in 2024, inflation has reached significant levels which are incredibly close to those of the previous major inflation in the 1980s.

“I feel that in the recent future, Inflation will continue to increase progressively unless there is something very impactful that will occur,” sophomore Maryam Boubacar said. “It is also important to note that inflation has been affecting people for a long time. However, from what I think about inflation decreasing, I would say it would take maybe 5-10 years for there to be a noticeable shrink in inflation for our economy.”

Throughout history, the consequences of inflation have remained the same: people have lost their jobs, lost their homes, suffered increased prices, adjusted to increased interest rates, and experienced reduced purchasing power.

“Inflation affects the jobs that people are willing to do as some provide more money than others, which in times of high inflation will help pay for things such as food, water, and utilities, sophomore Tanvi Puthumbhaku said. “It affects the rate of homelessness and poverty as people can’t afford basic necessities.”

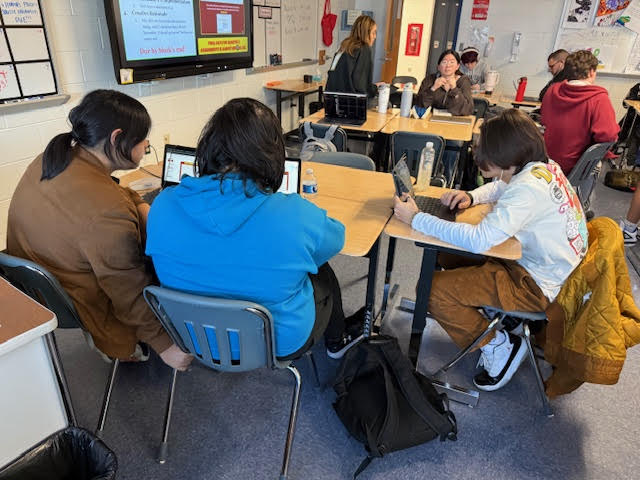

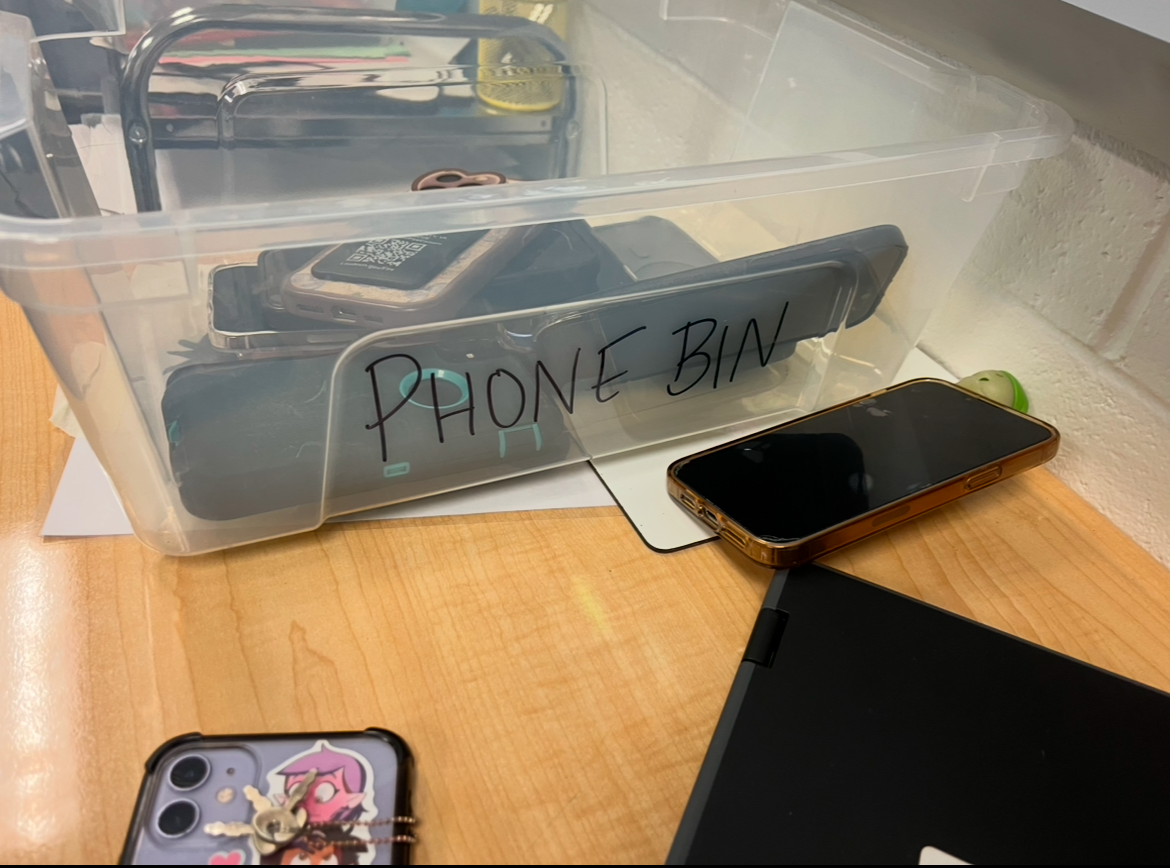

(Sasha Vieri)